The rules of supply and demand never go away

However much oil has eased, this idea that oil prices will fall again as the US economy slows down is (a) technically correct, but (b) wildly off the mark. The US economy just isn’t as big a deal as all that, these days. Emerging markets are easily making up the difference, even now.

The stunning rise in energy prices, fueled by an increasingly volatile and unpredictable market, seemed to pay little attention to the warnings over the health of the U.S. economy. Last week, Ben Bernanke, chairman of the Federal Reserve, said the economy was headed for slower growth. The message prompted a sell-off on Wall Street and stoked new fears of a possible recession.

Asked whether he was concerned that a slowdown in the United States could reduce demand for oil there, Naimi said: “We do not wish any country to go into a recession, particularly the biggest consumer in the world. We hope it doesn’t happen, and we’re not planning on that happening.”

Why in hell should it pay much attention to the warnings over the health of the US economy (warnings including, by the by, the latest from the IMF)?

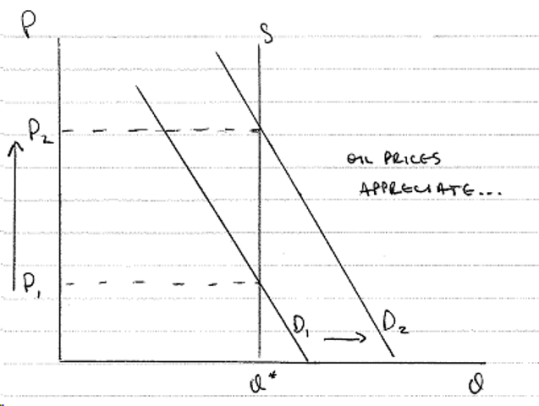

The argument runs along these lines: supposing oil is in fixed supply (it could be merely inelastic: it makes no real difference to our analysis). Then a boost in world oil demand, coming out of emerging economies, increases the price:

Oil prices of P2 increase the costs of production; they increase prices, generating inflation; the inflation devalues incomes and household wealth, lowering consumption and investment. Remember the equation for macroeconomic equibilibrium:

Aggregage Demand = Consumption + Investment + Government Expenditure + Net Exports

So, increase oil prices and decrease Aggregate Demand/Aggregage Incomes. Demand for goods and services declines; the US demand for oil shifts downwards/inwards, as does the world demand for oil:

However. While this is going on, those emerging markets still are advancing, in some cases quite rapidly. Each country can expect a similar pattern to emerge as the one above, but many are also under-writing economic growth (or, as with China, trying to avoid unemployment. Iran, trying to avoid more riots. Motives vary), so the impact of appreciating oil prices is muted.

The curve D3 is simply not likely to return to the position of D1. Arguments that oil will go back to the low low prices of yore rely upon this outcome. Simultaneously, and depending upon one’s views, some or more of the following may also occur:

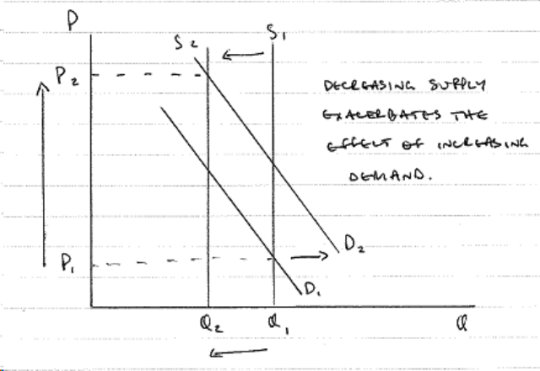

1. Declining yields from oil fields

We’ve seen this already and, certainly in the short-term, we’ve seen it with political or climate instability. Supply shrinks. The effect on prices? Dramatic.

Specifically, appreciating oil prices. Supposing that occurs simultaneously with increasing global demand (the scenario in which people like me believe):

2. More technological innovation (a) more oil

Another argument is that, as oil prices appreciate, we’ll be able to go after the less-cheap stuff. I.e., we’ll go out and find/tap more oil:

In this version, prices stay the same. Or, rather, they appreciate to P2, but then return to P* as more supply is brought on-line (this gets back to OECD demands that OPEC increase their output – assuming they can).

3. More technological innovation (b) more alternative fuels

Another argument still is that, as oil prices appreciate, our rocket scientists will figure out how to fuel our cars with the indignation of environmentalists, or something. What will this achieve? First, demand should shrink, as oil-demanders become biofueld-demanders (for example). Second, as more substitutes for oil come to the market, the demand curve for oil becomes more elastic – such that changes in demand have less of an impact on prices:

Even if oil yields continue to shrink, the decline in supply (to some undrawn S2 < S1) will generate less of a price increase than is currently the case, with inelastic demand for oil.

The question then is, which is more likely to occur? Like I said above: it depends upon whose science you believe; whose data you believe; whose econometrics/economics you believe. I’m with the peak oil crowd: I think supply is declining. I think appreciate oil prices are hurting, and will continue to hurt, the US economy, but I think other economies are going to advance anyway: I don’t think oil prices will return to anything like the levels we’ve come to enjoy in the US.

I’m also, therefore, with the Clusterfuck Nation crowd. The US economy is built on cheap oil, and we won’t have it anymore. So far we’re running on our advantage in terms of refining capacity, but that won’t last long, either. That world oil price is going to stay pretty high – a lot higher than levels at which many US (and many European) industries can make money. Our exurban, strip-mall lives are in trouble.

[…] immediate price effects of course are about as “no” as brainers get. This is an interesting phenomenon to watch, though going forward. Will it expand into other […]

Well I suppose your analysis was a little off..

thanks for the help!! it was of great use!!!

Thankyou, Really helped me with understanding this subject